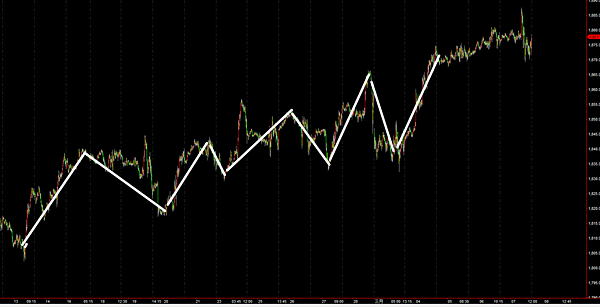

這是一個蠻特別的進場方式運用在外匯類期貨(現貨保證金也適用)

策略思考流程:

1.假設:

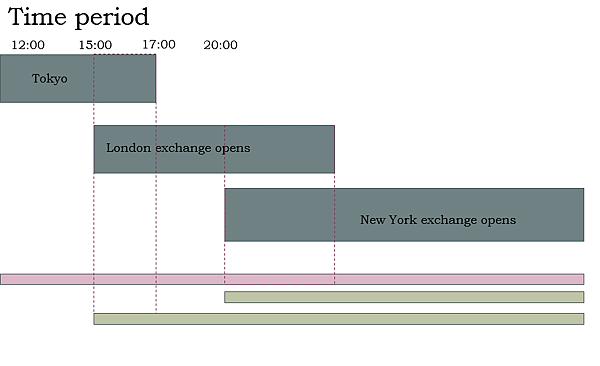

外匯期貨成交量是從下午倫敦交易所開盤後開始增加延續到晚上new york 交易時段,價格波動也是如此.

在這兩個交易所時段會造成價格大幅跳動的通常是重要經濟數據發佈時,如 PMI,GDP 或央行升降息.

一般投資者當然是等發佈後再去順勢進場,或發佈前去猜方向,因為我們不可能提前知道經濟數據的消息.

但如果是一些大型投資機構,是否能提前知道呢?或是因要建立的部份太大所以需要提前一段時間去佈單.

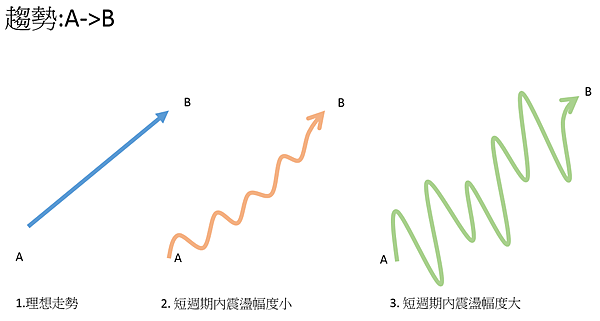

所以假設:

需建立大量部份的投資者,事前已經由消息或數據判斷出下午倫敦或晚上紐約可能的走勢,

所以在東京交易時段價格波動不大時就開始佈單,因為大量佈單進場可能會造成價格往該方向移動

故策略可以定出:

如果在東京盤的一段時間價格是往上的,那就在下午倫敦盤時作多.往下就做空

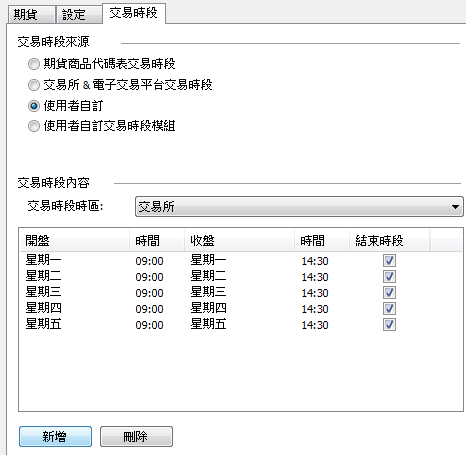

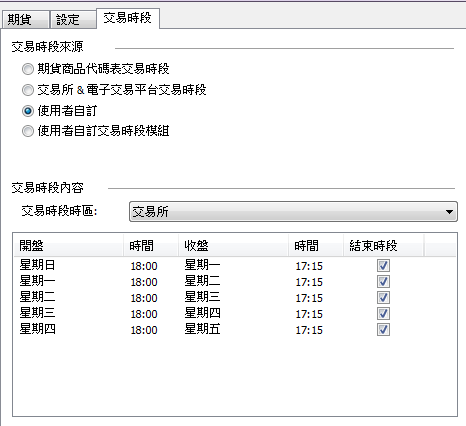

下圖是以台北時間為主,三個交易所開,收盤時間

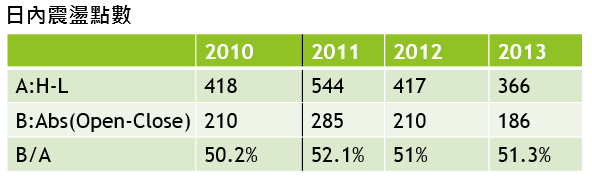

2.統計及策略制定

事實上,我這假設蠻牽強的,看起來好像有道理但完全是用自己的想法去假設的,沒有任何證據.

還好現在交易的統計工具都蠻容易使用的.我們只要寫個簡單程式就能驗證想法對不對了

首先就是要找出時間:

東京交易所的一段時間上漲->找出那一段?

倫敦交易所開盤後去下單->找出開盤後過多久?

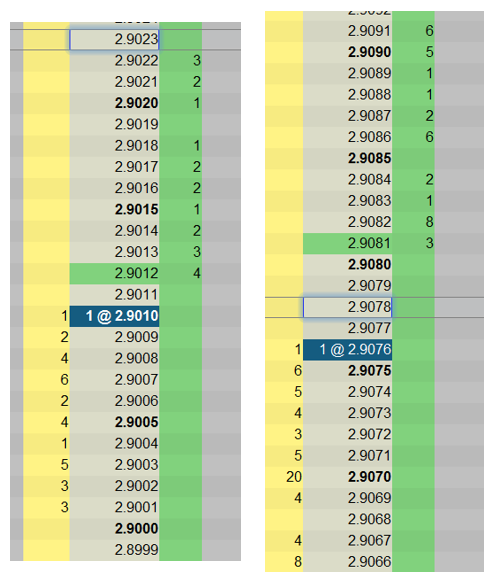

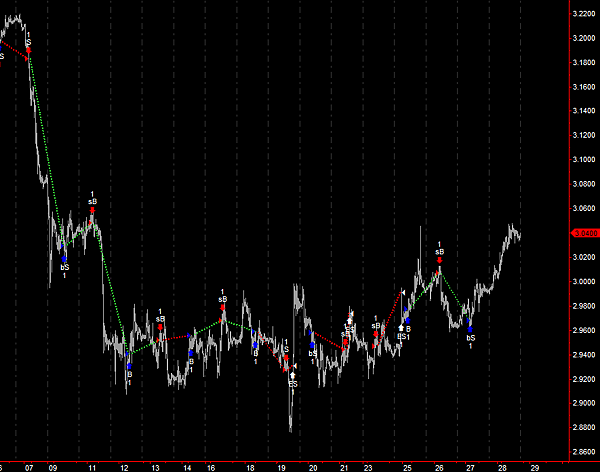

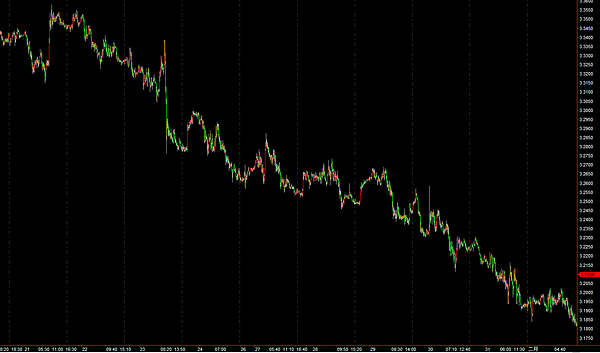

我以歐元做這個統計,發現如果在 CME 交易所時間21:30~22:30 (就是我們當地時間10:30~11:30)

如果這一小時走勢是漲的那在CME 交易所時間 06:30(就是我們當地時間17:30 ) 就去做多,猜走勢延續

如果是跌,就放空,同樣猜走勢會延續.

停損,停利皆為50點 (因為只是要了解是否這個時段的走勢是否有延續的特性)

如果放到收盤前沒停損也沒停利就出掉.

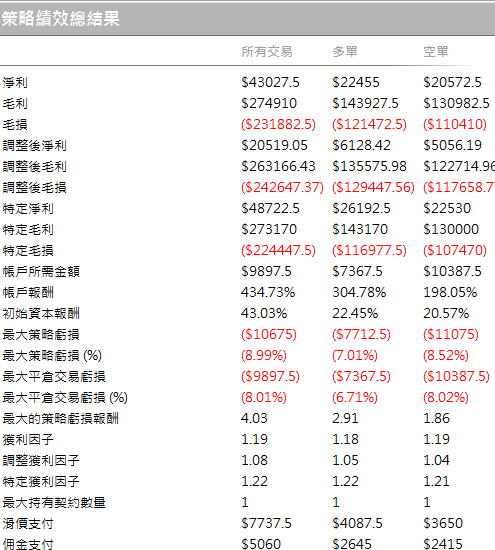

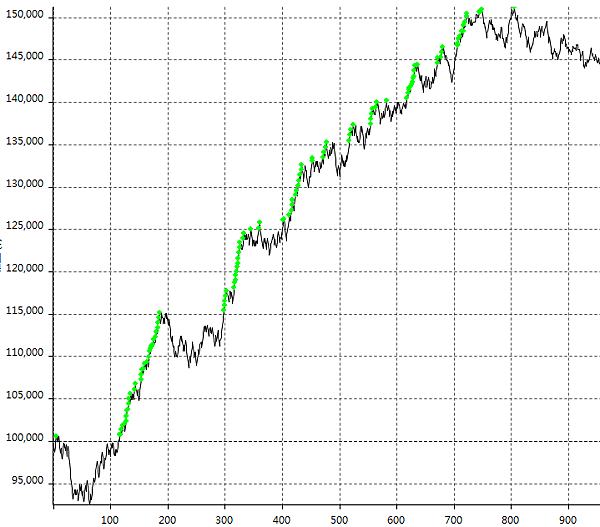

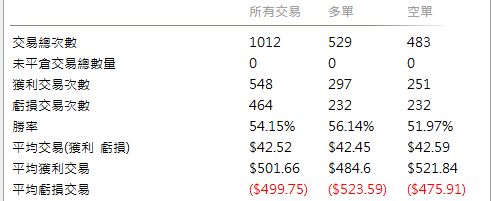

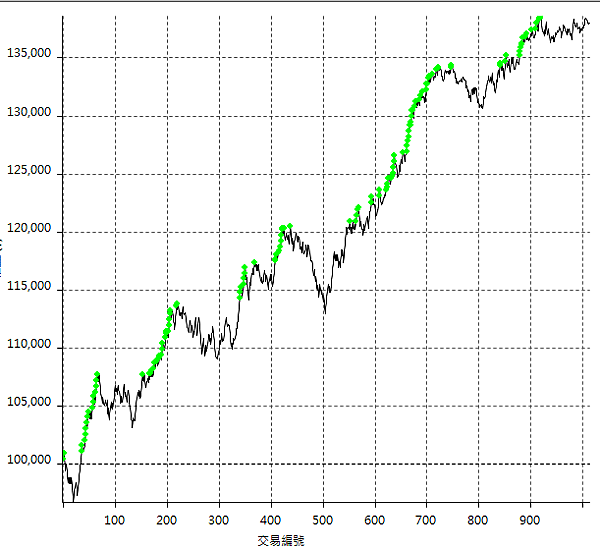

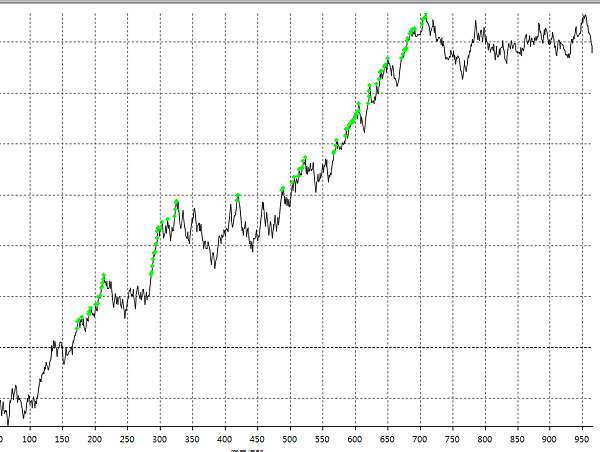

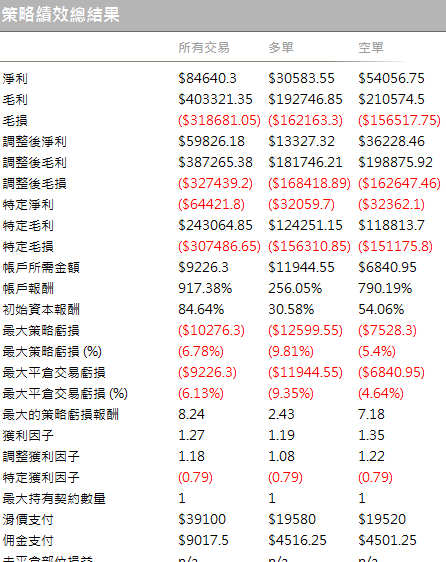

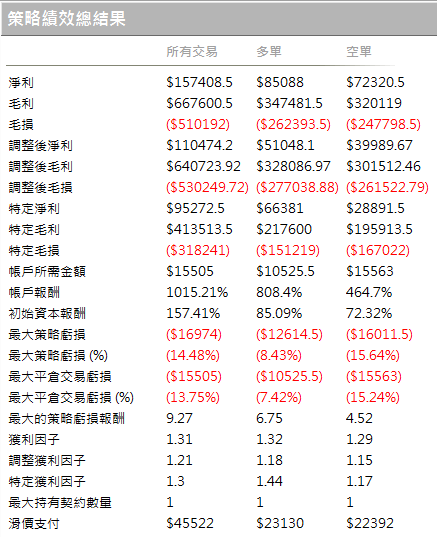

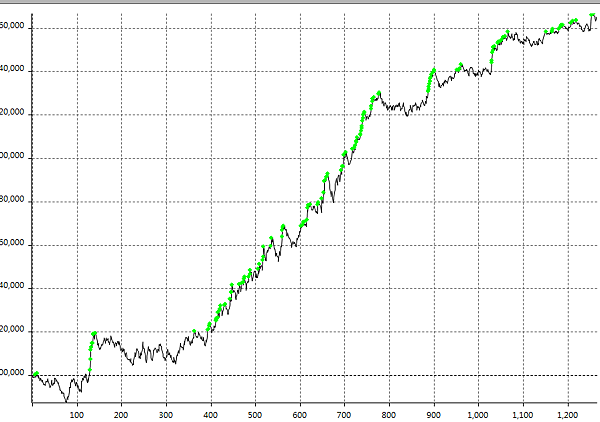

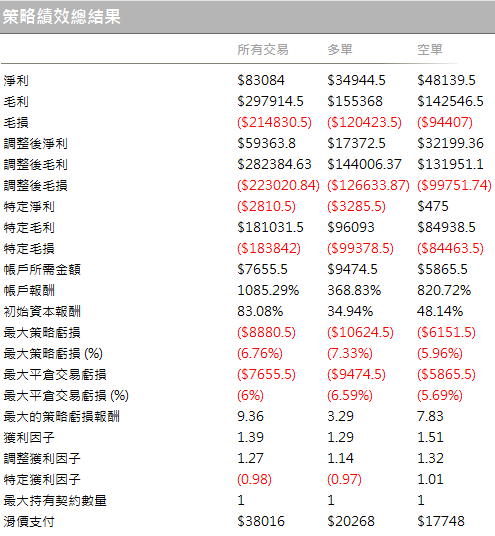

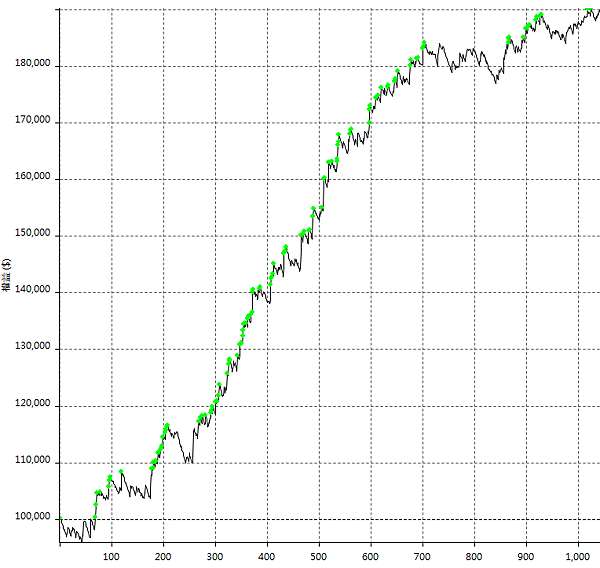

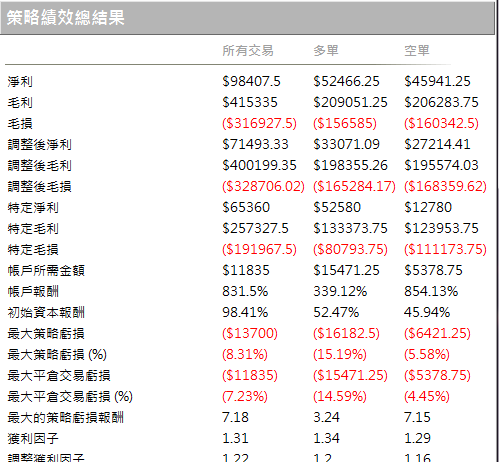

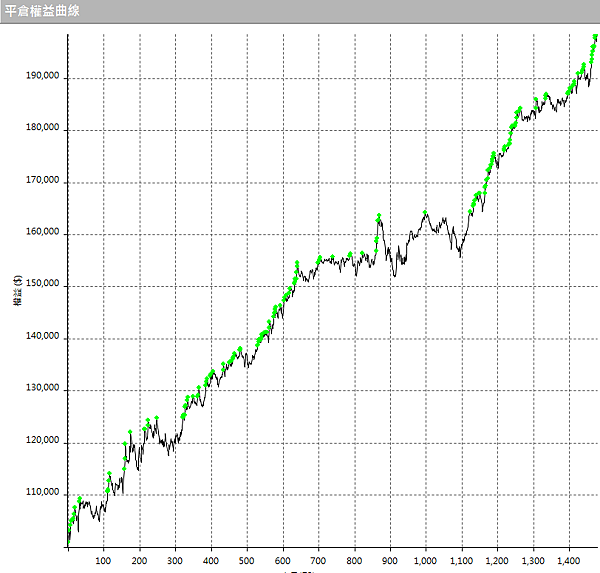

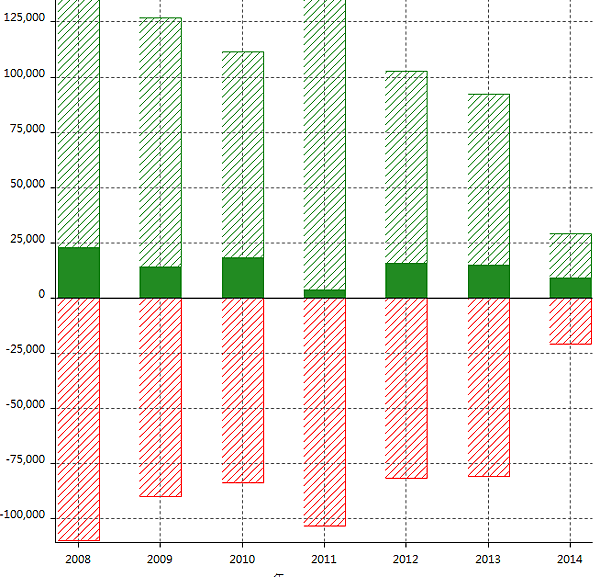

測試結果+績效:

標的:歐元期貨

K棒週期:30分鐘

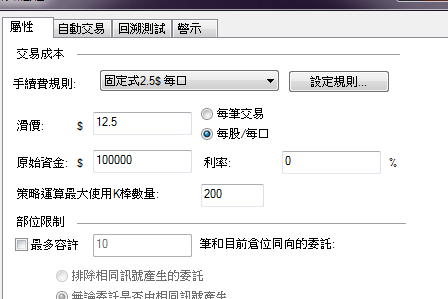

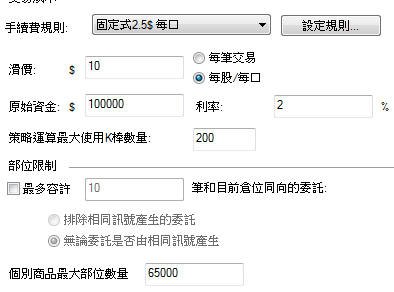

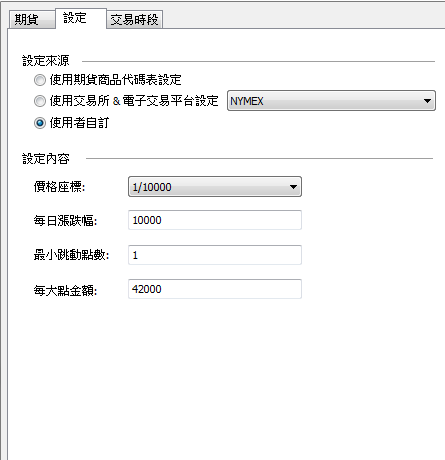

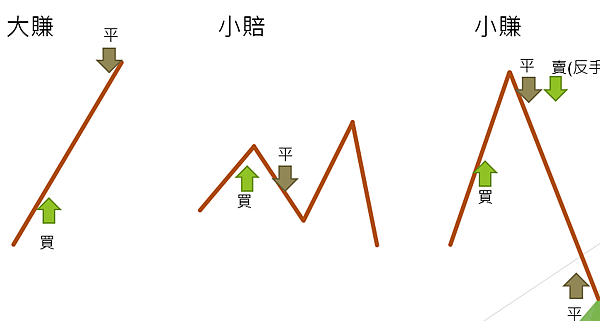

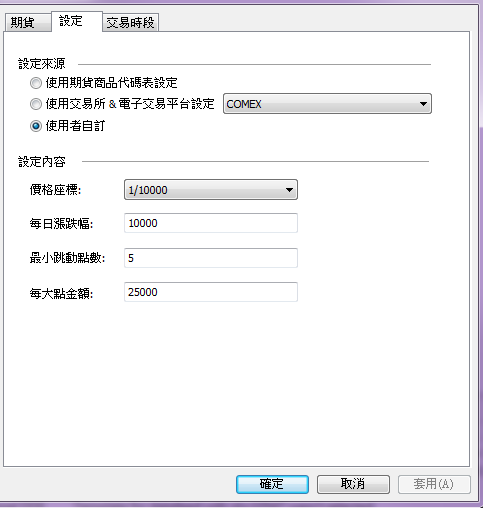

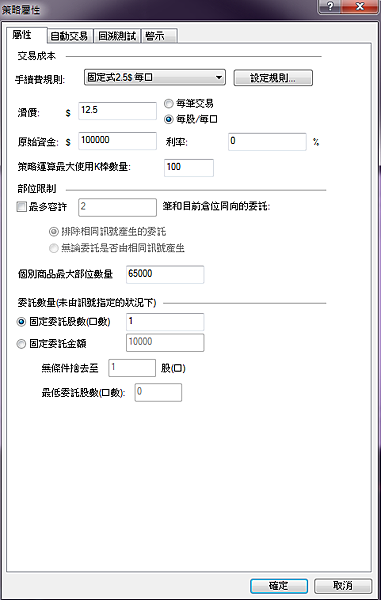

手續費及滑價設定:

測試日期:2009~2014/5 (使用CME交易所時區)

結果:

由結果可以得知:以台北時間10:30~11:30(夏令),這一小時的漲跌去猜下午17:30後的走勢,停損停利各為50點

勝率是大於5成的,由回測結果得知勝率是54.15%.平均每筆可以獲利42.52美元

也就是這個假設的想法應該是成立的.

附上程式碼供參考:

inputs:gain(50),loss(50);

if time=2230 then begin

value1=close ;

value2=close[2] ;

end;

if time=0630 and value1-value2>0 then begin

buy next bar at open limit;

end;

if time=0630 and value1-value2<0 then begin

sellshort next bar at open limit;

end;

if marketposition > 0 then begin

sell next bar at entryprice(0)+MinMove*gain point limit;

sell next bar at entryprice(0)-MinMove*loss point stop;

end;

if marketposition < 0 then begin

buytocover next bar at entryprice(0)-MinMove*gain point limit;

buytocover next bar at entryprice(0)+MinMove*loss point stop;

end;

if time>=1500 then begin

sell next bar at market;

buytocover next bar at market;

end;

這裡說明一下:

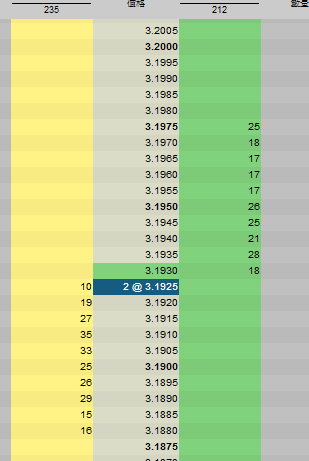

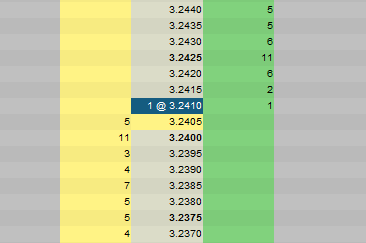

可以看到我進場用Limit ,因為進場時間點是下午05:30(台北時間),那段時間沒什麼消息公佈,

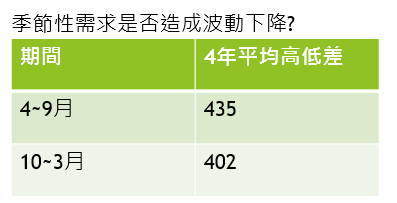

而且進場方式不是突破去追價,或大賺小賠的模式.

以這策略來說,用limit 單可以減少不必要的滑價,以程式寫法就是會掛出 limit at open 價,掛單時間30分鐘,如果沒成交就會取消

3.驗證:

思考到這裡應該會有一個很大的疑問?

為什麼時段要捉:台北時間10:30~11:30,(21:30~22:30 CME)?為什麼是這一小時?

倫敦交易所交時區間那為久,為什要進場時間點是台北時間:17:30(06:30 CME),而不是18:00,18:30??

這些時段有什麼理由?

說真的,我不知道.因為這是利用程式在各個時段跑出來的結果.使用這段時間會是獲利的.

假設的核心在於大資金者可能有較大機率預測出之後(下午)的走勢,所以會先佈單(早上)

如果這假設成立,其它幣別的外匯期貨應該大部份都要適用,而且時段一定要相同.

為了驗證,我把這策略直接套用在其它幣別上.

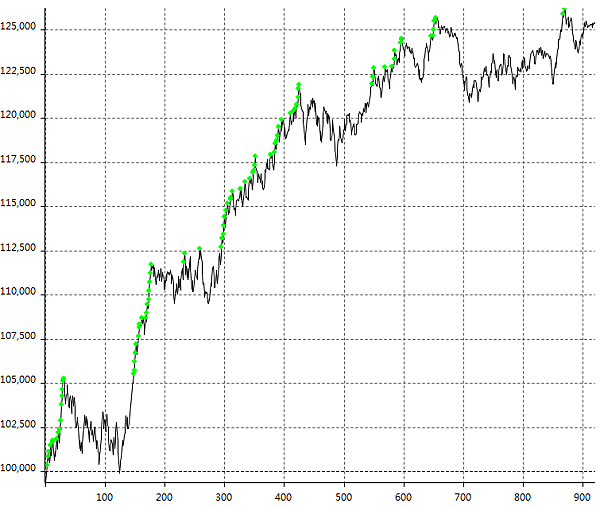

首先是跟歐元相關性很小的澳幣(如果先測跟歐元相關性大的SF 就沒什麼意義了)

測試結果

程式跟上面歐元完全一樣

標的:澳幣期貨

手續費+滑價設定

澳幣的結果是獲利的,表示這個時段是有意義的,不是只限於單一貨幣的現象

再來套用在加幣上

測試結果

程式跟上面歐元完全一樣

標的:加幣期貨

當然跟歐元相關性大的瑞士法朗也是獲利的

標的:瑞士法朗期貨

每個貨幣期貨的停損停利點數可以變更,績效會變穩定一些.(但時段不能變,一變就沒有意義了)

這個50點只是我一開始隨便設的,因為要確定如果停損停利相同這樣做的勝率是否大於5成.

可以設成其它的值,或也不用停損停利都相同.

而且可以加入一些比較靈活的出場模式,如進場後如果一段時間都沒獲利就先出掉

最後:

這樣驗證下來,可以確定下午走勢有較大的機率會延續早上那段時點的走勢.

那除了外匯,是否也可適用於其它商品呢?

這就有再研究的空間了~

.jpg)

.jpg)